Disclaimer: Information in this guide may no longer be current when you read it. For the most up-to-date advice and personalised guidance, book an appointment with a registered migration agent at My Visa Guide.

Applying for an Australian Student Visa (Subclass 500) today means setting aside AUD 2,000 just for the application fee—by far the steepest charge worldwide. On top of that, you’ll need Overseas Student Health Cover (OSHC), which typically ranges between AUD 700–1,200, and meet the AUD 21,041 annual proof-of-funds requirement.

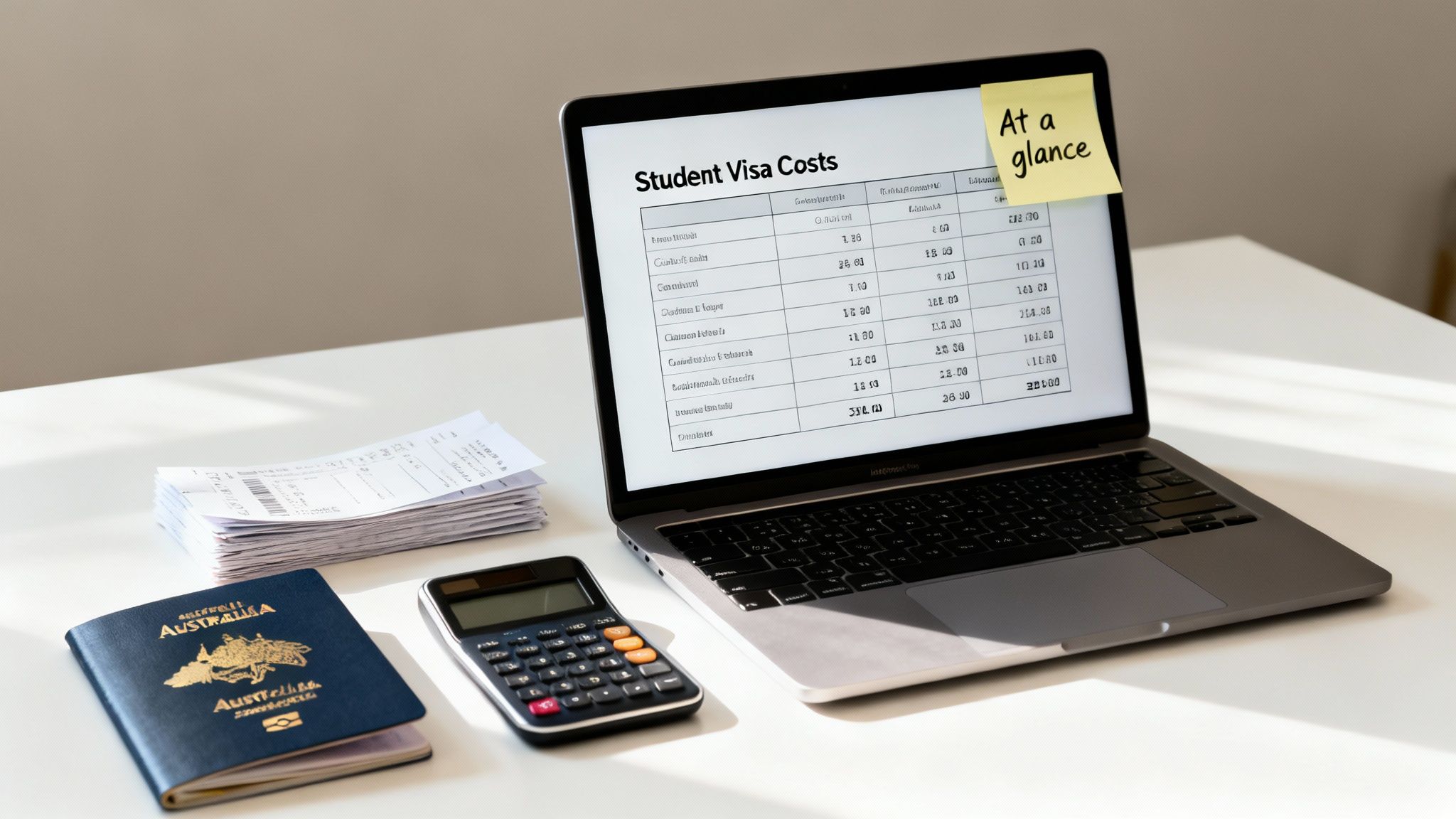

Australia Student Visa Cost At A Glance

Getting to grips with these numbers early on helps you build a realistic budget and sidestep nasty surprises down the track. If you’d like tailored advice, our team is ready to help: Student Visa Assistance Subclass 500.

- Visa Application Fee: AUD 2,000

- Overseas Student Health Cover: AUD 700–1,200

- Proof Of Funds: AUD 21,041

Key Takeaway: Always double-check these fees with a registered migration agent before you submit your application.

Key Cost Components for Australia Student Visa

Below is a concise breakdown of the core expenses you’ll face when applying and maintaining a Subclass 500 visa.

| Cost Component | Typical Cost (AUD) | Notes |

|---|---|---|

| Visa Application Fee | 2,000 | Subclass 500 application charge |

| Overseas Student Health Cover | 700–1,200 | Depends on provider, policy length and cover |

| Proof Of Funds Requirement | 21,041 | Annual living-cost benchmark set by Home Affairs |

Since mid-2024, the application fee has climbed from AUD 710 to AUD 1,600, and as of 1 July 2025 it reaches AUD 2,000 (around US$1,323 at current rates). For a deeper look at these changes and handy budgeting tips, head over to IDP’s guide: Visa Updates and How to Budget.

Having a clear view of these upfront costs lays the groundwork for exploring tuition fees, living expenses and any extra charges in the upcoming sections.

Disclaimer: Fees and requirements can change without notice. Consult a registered migration agent for the most up-to-date information.

Visa Application Fee Hikes And Their Impact

Over the last ten years, the Subclass 500 visa fee has crept upward, reflecting shifts in policy and budget priorities. What began at AUD 710 in 2019 jumped to AUD 1,600 on 1 July 2024 and then climbed again to AUD 2,000 on 1 July 2025. Many students have had to revisit their budgets, pick shorter courses or even push back their application dates.

Reasons Behind Fee Increases

In essence, visa fees are now a substantial revenue stream. Official estimates suggest these hikes will generate an extra AUD 2.4 billion over three years.

At the same time, the government aims to temper student numbers. By using ministerial determination rather than a full legislative process, fees can change quickly—no lengthy parliamentary debate needed.

- Direct funding for domestic student support

- Faster policy rollouts via ministerial powers

- Alignment with the broader international education strategy

“Higher visa fees act as both a revenue lever and a tool to modulate student intake,” says Professor Andrew Norton.

Effects On Application Volumes

We’ve seen a clear link between fee rises and fewer applications. When the visa cost hit AUD 2,000, lodgements and grants dipped sharply—ELICOS providers were hit hardest, and rejection rates climbed.

Prospective students now face tougher decisions: push for a full-degree course or hold off until costs stabilise. For deeper insights, check the PBO report on student visa fees.

Case Study

One Sydney ELICOS centre recorded a 30 % drop in enrolments immediately after the latest increase. With revenue down, they closed evening classes and restructured four departments.

- Smaller class sizes in language institutes

- Staff reductions in short-course programs

- Increased marketing budgets to attract students

Advocacy Group Responses

Education providers have been vocal, calling for smoother, predictable fee paths. Their proposals include phased increases tied to real performance metrics rather than flat jumps.

- Open appeals to the Education Minister for staged fee models

- Letters from university alliances suggesting alternative levy schemes

- Calls for thorough industry consultation before any new hikes

Key takeaway: Experts warn that sudden fees undermine Australia’s appeal as a study destination.

Student Budget Planning Tips

Knowing the backdrop can save you from nasty surprises. Always factor in an extra AUD 300 buffer for visa fees and compare deadlines carefully.

Start early with a migration agent or advisor to spot trends. Keep your budget nimble and watch for Home Affairs announcements.

- Track official announcements on fee updates

- Set up alerts for Home Affairs fee schedules

- Review cohort timelines to align application windows

Broader Budgetary Insights

It’s not just about student visas. Annual budget papers show fee revenues earmarked for domestic scholarships and campus infrastructure. While that makes political sense, too-steep hikes risk dampening international interest.

- Forecast models assume steady international intake

- Trade-offs exist between revenue targets and sector health

- Universities Accord reforms may revisit visa levy concepts after 2027

This policy environment is fluid. Prospective students should stay informed and flexible.

Disclaimer: Book an appointment with a registered migration agent in Australia for the latest visa fee details and requirements as policies can change.

Proof Of Funds Requirements For Student Visas

Imagine your proof of funds as a financial passport—no valid stamp, no entry. When you apply for a Student Visa (Subclass 500), the Department of Home Affairs expects clear, consistent records.

You must show enough money for AUD 21,041 in living expenses per year, plus upfront tuition deposits and Overseas Student Health Cover premiums. Solid documentation keeps delays at bay and reinforces your genuine student claim.

Accepted evidence includes bank statements, education loan letters and sponsorship affidavits. If dependants join you, each adult adds AUD 7,362 and each child AUD 3,152 to the total.

- Bank Statements: At least three months of history

- Loan Approval Letters: Detailed disbursal schedules

- Sponsorship Affidavits: Certified declarations from parents or organisations

Key Insight

Misdated statements or low balances are top reasons for visa refusals.

Accepted Proof Of Funds Documents

Not all documents carry the same weight. A bank statement showing daily balances well above the threshold speaks volumes. Loan letters must specify exact amounts and release dates. Sponsorship papers need certified translations if they’re not in English.

| Document Type | Purpose | Notes |

|---|---|---|

| Bank Statement | Validates personal savings | 3 months’ history, official letterhead |

| Loan Letter | Confirms educational loan approval | Must outline payment schedule |

| Sponsorship Affidavit | Shows third-party financial support | Include sponsor’s identity proof |

Think of each document as a trail marker guiding the case officer through your financial history. Missing even one can make the path look broken.

Certification And Translation Requirements

Any document not in English must be translated by a NAATI-accredited translator. Getting papers certified by a solicitor or notary public adds extra credibility and helps you avoid processing hiccups.

Calculating Minimum Amounts

Start with AUD 21,041 for living costs, tack on a typical tuition deposit of AUD 5,000 and OSHC premiums around AUD 700. Remember, some OSHC plans include extras like dental or ambulance cover at slightly higher rates.

Tuition deposits usually represent 10–25% of your total fees. Factor in return flights, which can swing wildly with seasonal fares, so plan ahead to dodge last-minute price hikes.

Families need an extra AUD 7,362 per partner and AUD 3,152 per child. Since 10 May 2024, you also must prove you can cover return travel, on top of the AUD 2,000 VAC charge, pushing more applicants toward tighter budgets and higher rejection rates. Learn more about rising visa costs on Monitor ICEF Learn more about rising visa costs.

You might be interested in our guide on genuine student requirements: Learn more about genuine student requirement in our article.

Common Mistakes To Avoid

- Using statements older than six months

- Failing to convert foreign funds accurately

- Uploading unsigned affidavits or missing translations

“Incorrect dates and insufficient buffers are the most frequent proof-of-funds errors,” advises migration agent Vijay Bharti.

Here’s an OSHC cost estimate screenshot showing typical premiums and coverage tiers.

This visual highlights how premiums shift by provider and policy length, making it easier to budget correctly. Keeping your proof buffer above 10% offers extra security against sudden exchange-rate swings.

Tips For Strong Financial Evidence

- Maintain an extra buffer of 5% above minimum amounts

- Certify or notarise documents when required

- Align statement dates with your visa submission date

- Draft a summary table listing all fund sources and totals

- Keep both digital and printed copies to prevent data loss

- Double-check exchange rates when converting foreign income

Always confirm your calculations with a registered migration agent to steer clear of unexpected shortfalls. Fees and requirements can shift without notice, so act early and stay informed.

Tuition Deposits And OSHC Living Costs

Once you’ve received your unconditional offer, the very first step is to secure your spot with a tuition deposit. Typically, this upfront payment ranges between AUD 5,000 and AUD 10,000, depending on your course fees. Most universities align this deadline with the visa grant date to keep your enrolment and visa timeline in sync.

Think of the deposit as a hotel booking fee—it demonstrates your commitment and holds your place. If you miss the deadline, the institution may reallocate your spot to someone on the waiting list.

Offers usually specify a clear due date in calendar days. Match your payment with your visa application timing to avoid any unwanted surprises. And if you must cancel, review the refund schedule carefully; some institutions refund part of your deposit if you withdraw by certain dates.

Comparing OSHC Premium Tiers

Choosing the right Overseas Student Health Cover is more than ticking a visa requirement box—it’s about managing your health costs while you study. Here’s how the main providers stack up:

- Allianz OSHC Standard: AUD 710 per year for single students

- Bupa OSHC Basic: AUD 830 per year (includes limited dental cover)

- Medibank OSHC Comprehensive: AUD 1,250 per year (adds ambulance services)

“A well-chosen OSHC policy could save you up to AUD 200 annually,” says a health insurance adviser.

For an in-depth breakdown of benefits, exclusions and how to compare quotes, see our guide on Overseas Student Health Cover (OSHC).

Medical And Biometrics Fees

Beyond OSHC, the Department of Home Affairs requires a medical exam and biometric collection. Expect medical costs between AUD 300 and AUD 600, based on the panel physician you choose and the number of tests. Biometrics appointments generally carry a AUD 90 fee when booked through participating centres such as Australia Post.

Plan these bookings at least six weeks before your departure. That way, you’ll have your health clearance ready when your visa decision rolls in.

Living Costs Breakdown

Australia’s cost of living swings widely between cities. Your weekly budget must cover rent, groceries, transport and utilities. While Sydney and Melbourne sit at the higher end, regional towns can be around 30% more affordable.

To give you a clearer picture, here’s a snapshot of average single-student expenses:

Average Living Costs by City

Comparison of weekly living expenses for major Australian cities

| City | Weekly Cost (AUD) | Notes |

|---|---|---|

| Sydney | AUD 550 | High rent in central areas |

| Melbourne | AUD 500 | Slightly lower transport fares |

| Brisbane | AUD 450 | More affordable housing suburbs |

| Adelaide | AUD 420 | Lower grocery and utility rates |

These figures represent a typical single-student lifestyle. Always build in a 10% buffer for unexpected expenses.

Consider these money-saving tips:

- Share a house or apartment to reduce rent by up to 30% per person

- Split utility bills with flatmates to cut household costs

- Apply for a student Opal or Myki card to get discounted public transport fares

Aligning Payments With Deadlines

Coordinating key dates will keep you on track and help avoid penalties:

- Confirm your academic offer and note the deposit deadline

- Arrange your OSHC start date to coincide with or precede your visa grant

- Book medical exams and biometrics six to eight weeks before travel

- Keep all payment receipts handy for visa evidence

Regularly check your MyVisaGuide account or your institution’s portal for any updates.

Disclaimer This content is for informational purposes only. Fees and timelines can change without notice. For personalised advice on your Student Visa (Subclass 500), book an appointment with a registered migration agent at My Visa Guide.

Costs For Dependents And Additional Applicants

When you decide to bring a spouse or children to Australia under the Subclass 500 visa, your overall australia student visa cost climbs noticeably. You’re not just looking at extra visa charges; health cover premiums, proof-of-funds thresholds and even schooling fees all add up. Think of it like fitting puzzle pieces—each family member introduces a new piece you need to budget for.

In rough terms, adding:

- A spouse (18+) means showing an extra AUD 7,362 in living costs

- Each child requires AUD 3,152

- A family of four needs about AUD 14,676 more in your proof-of-funds

Visa application fees for dependents start at AUD 720 per person. Guardian visas carry different charges depending on the applicant’s age and the length of stay. Always double-check the Department of Home Affairs site so nothing catches you off guard.

Overseas Student Health Cover also jumps when you add family members. Generally, a spouse will tack on about a 50% surcharge to the standard OSHC rate, while each child under 18 costs roughly AUD 300 per year extra.

Documenting Proof Of Funds For Families

You’ll combine proof-of-funds for your dependents with your own bank statements. Each adult and child needs separate evidence—this includes:

- Spouse Living Cost: AUD 7,362 per year

- Child Living Cost: AUD 3,152 per year

- School Tuition Deposit: AUD 500–2,000 per child

For school-aged kids, you'll also need a Confirmation of Enrolment. Most schools ask for a deposit between AUD 1,000 and 2,500 to secure their place. Make sure these payments align with your visa application timeline.

Medical checks and biometrics apply to everyone over five years old. You can expect around AUD 300 per person for health exams plus AUD 90 for biometrics. Book these early to keep your visa processing on track.

Adding a spouse work rights application tacks on another AUD 510 fee. And if you explore partner sponsorship, budget AUD 8,000 for visa and sponsorship charges—plus you might engage a migration agent for an extra AUD 300–1,500 in professional advice.

Budgeting Example For A Family Of Four

Imagine you’re moving to Brisbane with a partner and two kids. Your breakdown might look like this:

- Visa Fees (4 persons): AUD 2,880

- OSHC Family Cover: AUD 1,750

- Proof-of-Funds Buffer: AUD 14,676

- School Deposits: AUD 5,000

That brings you to roughly AUD 23,000 before tuition and living expenses. To ease the pinch, spread payments over months or school terms. Lock in your OSHC early, then use the freed-up cash for unexpected costs.

Living regionally can trim OSHC and school fees, but keep travel expenses in mind. Always weigh total visa and living expenses together—shifting one cost might nudge another higher.

Key Takeaway: Family relocation can hike your australia student visa cost by up to 70%, so plan every dollar.

Concrete planning reduces stress and builds confidence. Set up a three-phase timeline—application, pre-departure and post-arrival—so each cost milestone syncs with visa requirements. Finally, keep all receipts in a single expense tracker and revisit Home Affairs and your OSHC provider’s websites before any big payment. That way, no fee changes will blindside you.

Budgeting Tips And International Cost Comparison

Working out a clear budget before you leave can turn those unknown visa costs and day-to-day expenses into something manageable.

Mapping everything out ahead of time cuts out nasty cash-flow surprises when lectures begin.

Whether you love a simple spreadsheet or a purpose-built app, seeing visa fees, OSHC premiums, tuition deposits and rent in one spot is a game changer.

Practical Budgeting Strategies

- Pick more affordable locales like Adelaide or Canberra, where living costs can be around 20% lower.

- To ditch hefty bank fees, consider opening an Australian bank account before you arrive.

- Some universities reward upfront tuition payments with a 5–10% discount.

- Digital wallets such as Pocketbook or MoneyBrilliant make keeping tabs on daily spending effortless.

Fitting in part-time shifts—mindful of the 48-hour weekly cap—can ease financial pressure.

Keeping an eye on exchange-rate swings and wiring lump sums when the AUD is strong could save you hundreds over a year.

Key Tip: Setting automated transfers and alerts keeps you on budget without constant manual tracking.

Prefer visuals? Our budgeting checklist calls out every milestone and due date—visa, OSHC, tuition—you name it.

Aim to tuck away about 10% of your total budget as an emergency cushion.

International Cost Comparison

| Country | Total Annual Cost (AUD) | Key Notes |

|---|---|---|

| Australia | 45,000 | High tuition and living costs |

| Canada | 40,000 | Lower health cover |

| UK | 42,000 | Slightly lower rent |

| US | 48,000 | Tuition can vary widely |

Glancing at these totals gives you a sense of how Australia stacks up against other destinations and helps you pick the best fit for your wallet.

- List every fixed cost—tuition, visa fees and health cover.

- Tally up living costs according to your chosen city.

- Convert local figures into AUD using up-to-date exchange rates.

- Factor in your part-time work limit and the going hourly rate.

Circle back to this spreadsheet whenever fees or exchange rates shift, so your decisions stay on point.

Emergency Fund Checklist

Think of your emergency fund as a safety ladder; each rung preps you for hiccups—from visa delays to sudden currency swings.

- Set aside AUD 2,000 for unexpected application fees or health checks.

- Reserve 3 months of rent in a separate account for emergency housing.

- Keep a credit card with at least AUD 1,500 available for urgent travel or medical needs.

- Use automatic transfers to move small amounts weekly into your emergency fund.

These simple steps mean one surprise cost won’t topple your entire plan.

Digital Tools For Daily Tracking

Apps such as Pocketbook and MoneyBrilliant let you tag transactions and ping you when you’re creeping over budget.

Link your bank feeds or credit-card statements into these platforms to do the heavy lifting, freeing up your time for study.

Pro Tip: Negotiate tuition deposit deadlines with your provider to align with your scholarship disbursement dates.

To minimise international transfer fees, compare remittance services like Wise or XE, both often under 1% per transfer.

Exploring salary sacrificing for rent or scholarships can also improve cash flow and reduce taxable income within visa work limits.

Always check current exchange rates and fee schedules before you act—this way your budget stays in line with market realities and visa rules.

Regional Study Options

Picking regional centres such as Hobart or Townsville can slice living costs by roughly 30%.

Many institutions sweeten the deal with scholarships or fee rebates for students who choose to study outside major cities.

Disclaimer: Fees are subject to change—book in with your trusted migration agent for the latest guidance.

Frequently Asked Questions

Whether you’re mapping out your Subclass 500 journey or simply double-checking figures, these FAQs lay out the essentials. We delve into the visa fee, health cover, proof-of-funds, family add-ons and refund rules—all in one place.

- Visa Application Fee

- OSHC Coverage Tiers

- Proof-of-Funds Benchmarks

- Dependants’ Conditions

- Refund & Cancellation Terms

- Exchange Rate Tracking

What Is the Current Application Fee

As of July 2025, the Student Visa (Subclass 500) application fee stands at AUD 2,000. This places Australia among the pricier destinations for international students.

Confirm the latest figures on the Department of Home Affairs site before you apply.

What OSHC Coverage Do I Need

Basic Overseas Student Health Cover starts at around AUD 700 per year. If you want extras—think dental check-ups and ambulance services—comprehensive plans can reach AUD 1,200 annually.

How Much Proof-of-Funds Is Required

You must prove you have at least AUD 21,041 per year for living costs. Adding a partner boosts that requirement by AUD 7,362, and each child adds AUD 3,152.

You can demonstrate this with:

- Three months of bank statements

- A student loan approval letter detailing disbursement dates

- A certified sponsorship affidavit

Can Dependants Work and Study

Partners are allowed up to 48 hours of work per fortnight during term time. Children receive their own student visas and must pay school fees separately.

Are There Refund and Cancellation Conditions

Most institutions set deposit deadlines that determine if you’re eligible for a full or partial refund. Note that visa application fees are non-refundable, with only very limited exceptions—always check with Home Affairs.

How Do I Track Exchange Rates

Set up alerts in your favourite currency-tracking app. That way, you’ll know the best moment to transfer funds.

Disclaimer: Fees and requirements can change without notice. For the most up-to-date advice, book a consultation with a registered migration agent.

For personalised assistance, contact My Visa Guide.